How to Grow your Revenue with Data

12 Mar 2024

Fintech is an extremely competitive industry. New products launch every day, and you often hear of young companies closing their doors. For these reasons, being able to grow your revenue is extremely important, and it’s one of the most effective ways to stay in business when the going gets tough.

Reduce Customer Churn

Many Fintech companies struggle to keep their customers. It’s understandable - switching costs are low and differentiation is difficult. But every customer that leaves is lost revenue, and lost revenue means more financial risk for your company.

Customer Complaints

The complaints department is a gold mine. When things are going well, people don’t say anything. But when it goes wrong, you’ll definitely hear about it. Complaints are important because they tie your customer’s feelings directly to an issue with your product. And if you turn those negative feelings into a positive experience of “Oh wow, they solved my problem,” then you have a new advocate.

Here are some questions to ask of your customer complaints department:

What is the issue your customers experience most often?

Where do they think your product is lacking?

What features would make your product better?

What needs do they have that you’re not serving?

By identifying and fixing these issues, you’ll increase customer satisfaction. This turns their complaint into an opportunity to improve your product and grow customer loyalty. Greater customer loyalty means happier customers, higher retention, and more revenue.

Customer Retention Campaigns

Can you predict which customers will leave?

The short answer is yes, as long as you have the right data. By collecting product usage data (logins, transactions, profile updates, account deposits etc.), you gain insight into the customer’s attitude towards your product.

To identify these at-risk customers, you look for patterns in the data mentioned above. Of the customers who closed their account, how long before they closed the account did they log in? How often did they transact or deposit cash into their account? If they haven’t performed any action on their account in the last 6 months, do you think they will remain a customer? It’s unlikely.

That’s where customer retention campaigns come in:

Does your product fix a pain point? Ask them.

Do they understand the benefits of your product? Market to them.

Do they know how to use your product properly? Educate them.

These campaigns can be done through customer service agents, email or even a new product feature. The point is to get in front of these customers often, with relevant material. Make them feel valued, and help them use your product to its fullest extent.

Cross-sell existing products

Understanding your customers and what they need is the most important thing you can do in a business. It allows you to see new opportunities and puts you in the best position to serve your customer’s needs.

As your company grows, you’ll look for new opportunities to serve your customers. A Fintech that first starts as a savings solution may expand further into investing or even become a bank. It all depends on what your customers need, your ability to find that out and to provide that service.

More products often mean more customers. It also means that your existing customers will have access to more of your products. But it doesn’t mean that all of your customers will use all of your products.

This provides an excellent opportunity to grow your business, because the Return on Investment (ROI) is huge. You don’t have to acquire them, because they’re already a customer, which also means you have an existing relationship with them. You’ve already done a lot of the hard work in gaining their trust.

So, how can you take advantage of this opportunity?

Analyze what products each of your customers use. Then segment them into groups of similar product usage. The process looks like this:

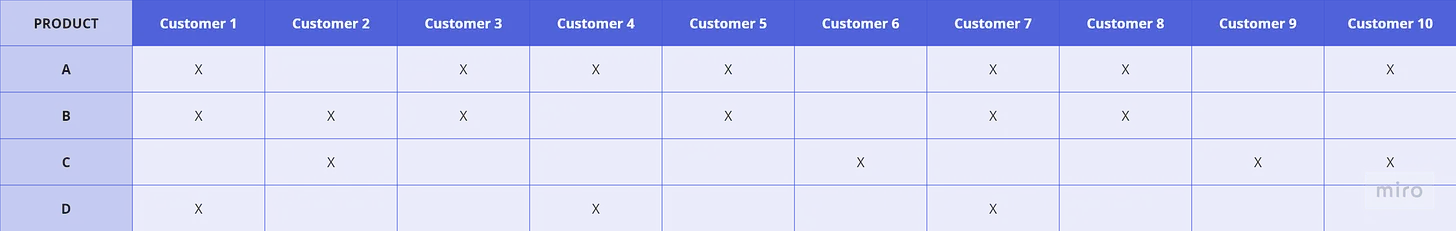

Table 1: Customer product usage

If we rearrange our table, a pattern in product usage (and an opportunity) becomes apparent:

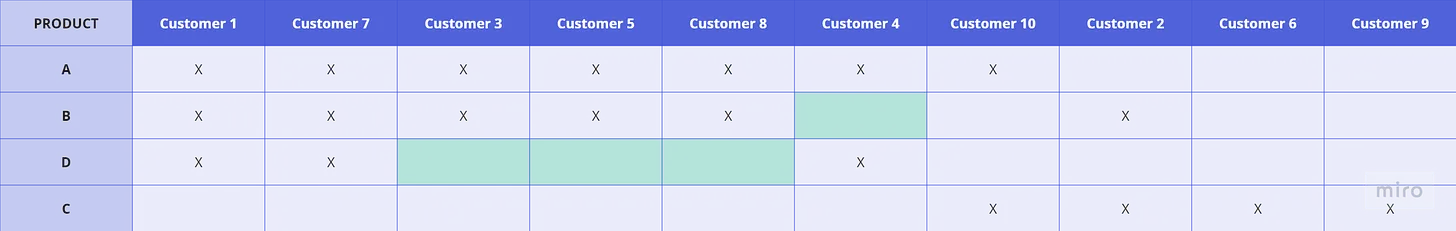

Table 2: Customer product usage grouped

Table 2 shows an opportunity to grow revenue by selling your products to customers who are likely to need them, but don’t yet use them. Customers 1, 7, 3, 5 and 8 all use products A and B, but only 1 and 7 use product D. You can see that it is a good idea to sell product D to customers 3, 5 and 8 and product B to customer 4.

This small scale demonstration seems rather insignificant, but the increase in revenue will be substantial when you have hundreds, or even thousands of customers, instead of just 10.

Conclusion

There is a lot of information available within your company. And most of it can be used to build a better business, one that serves its customers well and is more financially secure.